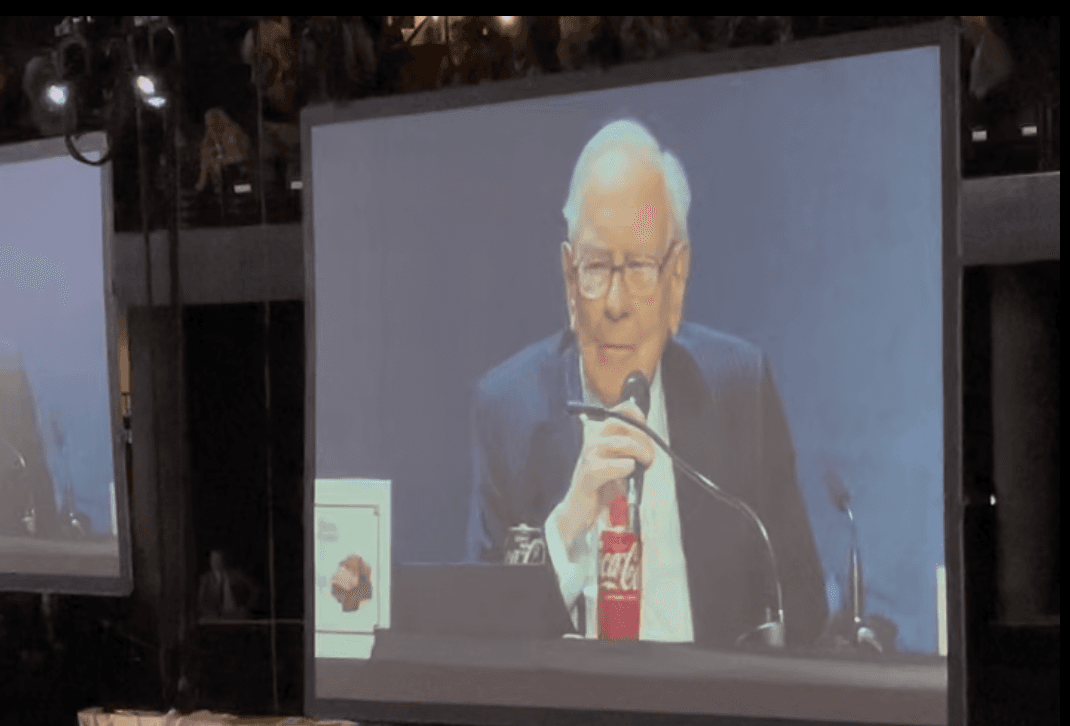

I want to talk about a really important shift happening at Berkshire Hathaway, and what it teaches us about investing the Rule #1 way. At the 2024 Berkshire meeting, Warren Buffett said something he’d never said before: he’s planning to leave Berkshire's capital allocation — the heart of investing — in the hands of Greg Abel.

Now that announcement has gone a step further: Buffett has officially confirmed he will step down as CEO of Berkshire Hathaway at the end of 2025, and Greg Abel, currently Vice Chairman of Non-Insurance Operations, will take the reins.

That’s a huge deal. And it reveals a powerful lesson for all of us about how to think like real investors.

Buffett’s Three Timeless Investing Principles

Buffett has hammered home the same three points his whole career, and they’re at the heart of Rule #1 investing:

Treat stocks like real businesses. Not pieces of paper. You’re buying a piece of a living, breathing business.

Understand that the market has emotions. Sometimes it’s wildly optimistic, sometimes it’s deeply pessimistic. Use that to your advantage.

Always demand a margin of safety. Buffett likes at least 50%.

"When you invest in the stock market, you're buying businesses. Full stop." — Warren Buffett

These principles haven't changed — and now, by selecting Greg Abel to lead Berkshire into the future, Buffett is reinforcing them louder than ever.

Why Greg Abel’s Appointment Matters to Investors

A lot of people thought Buffett would pass the investing baton to Ted Weschler or Todd Combs — guys who know how to buy and sell stocks. But instead, Buffett is handing it to Greg Abel, an operator, not a traditional "stock picker."

Why? Because great investing isn't about trading. It's about allocating capital like a business owner. It’s about seeing companies as real businesses — making smart decisions for long-term growth, not short-term stock price moves.

"If you understand businesses, you understand common stocks." — Warren Buffett

Now that Greg Abel is confirmed to succeed Buffett as CEO, that philosophy becomes even more important. Abel is known for his strong operational insight and disciplined leadership — the same qualities that drive great investment decisions.

Investing Like a Business Owner (Not a Stock Trader)

Here's the key: Invest like you own the whole business forever. Not like you're trying to flip a stock next week.

When I invest, I try to kick the tires myself. I’ve walked into stores like Urban Outfitters and Chipotle years ago, watching customer lines, feeling the buzz. I've traveled across the country to see what banks were actually investing in before buying their stock.

This is what Buffett’s talking about. Stay off the investing hamster wheel. Stop obsessing over price ticks and start obsessing over the quality of the business.

You have to operate independent of emotion — that’s your fortress against market fear.

That mindset — grounded in patience, discipline, and first-hand research — is exactly what Greg Abel brings to the table, and why his leadership is likely to reflect the Buffett philosophy investors have trusted for decades.

The Value Investing Cheat Sheet

Learn what 10 steps you should take to make smarter investing decisions

What Berkshire’s Future Teaches Us About Succession and Culture

Buffett’s decision to pass the CEO baton to Greg Abel highlights how crucial company culture and leadership are for long-term investing success.

Abel isn't just another executive. He’s someone who understands Berkshire’s unique culture — the discipline, the patience, the owner mindset. That’s not accidental. Buffett has spent years preparing Abel for this exact moment.

Buffett also emphasized the strength of Berkshire’s board. Good boards protect a company's values. But culture can shift over time. If future leaders lose that "owner mentality," the pressure to "do something" could eventually lead to short-term thinking.

As investors, we must watch not just financials, but leadership and culture. The handoff to Abel is a critical chapter in that story — one that appears to keep Berkshire's core philosophy intact.

What Rule #1 Investors Should Take Away

Think like an owner, not a trader.

Focus on wonderful businesses with strong moats, great management, and a margin of safety.

Stay emotionally resilient. Get comfortable being "punched in the face" when the market panics.

Watch for opportunities. When Berkshire (or any great company) goes on sale, be ready — but recognize it’s going to feel hard in the moment.

"Everyone has a plan until they get punched in the face." — Mike Tyson

With Buffett officially stepping down in 2025, many investors will be watching Berkshire closely. Emotions may run high. But that’s when your Rule #1 principles matter most.

The truth is, great investing isn't exciting day-to-day. It's slow. It's careful. It's about thinking long-term, allocating capital wisely, and having the emotional strength to hold on through the storms.

That's how Buffett built Berkshire. That’s what Greg Abel is expected to continue. And that's how you win as a Rule #1 investor.

If you want to learn exactly how to invest like a business owner — how to find wonderful companies, evaluate their leadership, and buy them with a margin of safety — then come join me at one of my Rule #1 Investing Workshops.

We’ll walk you through the exact strategies Buffett and I use, help you spot opportunities when others are afraid, and show you how to build long-term wealth by thinking like a true owner.

Start learning how to take control of your financial future the smart way.

Attend a Rule #1 Workshop

Learn how to conduct research, choose the right companies for you, and determine the best time to buy.